26+ 3 year mortgage calculator

Use our free mortgage calculator to estimate your monthly mortgage payments. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

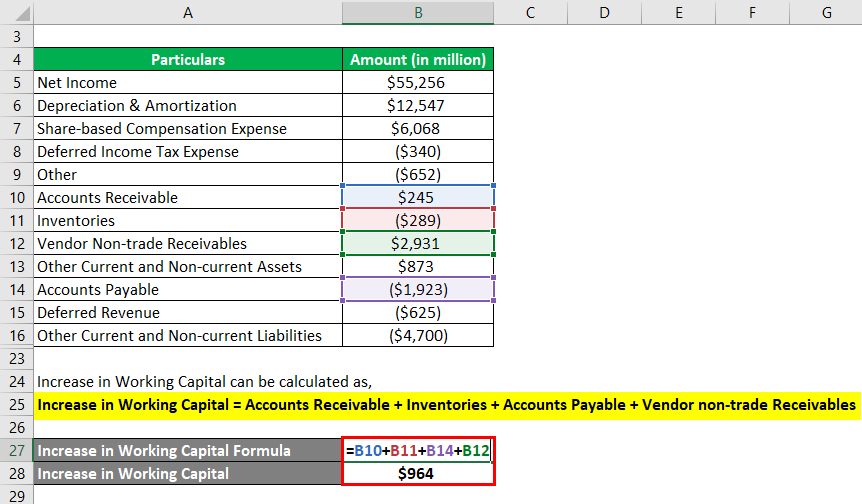

Operating Cash Flow Formula Examples With Excel Template Calculator

Average interest rate predictions put 30-year fixed rates at 388 and 15-year fixed rates at 327 in 2022.

. Defaulting on a mortgage typically results in the bank foreclosing on a home while not paying a car loan means that the lender can repossess the car. This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages.

Check rates today to learn more about the latest 30-year mortgage rates. We recommend seeking financial advice about your situation and goals before getting a financial product. They would charge a fixed rate of interest for 3 10 years respectively and then the loans would amortize at a floating interest rate for the remaining 27 20 years respectively.

Prince Edward Island Charlottetown 103 Cornwall 26 Stratford 66 Summerside 82 West Royalty 11. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. Check with your bank or lender to ensure that it will accept bi-weekly payments.

The same could be said for a 3 year IO or a 10 year IO loan. If they match youve done the formulas correctly. A 15-year fixed mortgage sits at 538 a 296 rise.

For example a 30-year. Your principal should match up exactly with the original loan amount. To talk to one of our team at ANZ please call 0800 269 4663 or for more information about ANZs financial advice service or to view our financial advice.

Cross-reference these values with your mortgage calculator. Chart represents weekly averages for a 30-year fixed-rate mortgage. Total Tax Insurance PMI Fees.

Average for 2022 as of August 26 2022. That means 26 half-payments or 13 full payments which is one extra payment per year. They would charge a fixed rate of interest for 3 10 years respectively and then the loans would amortize at a floating interest rate for the remaining 27 20 years respectively.

Use a mortgage calculator with. Historical 30-YR Mortgage Rates. This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or commercial lands.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. There are options to include extra payments or annual percentage increases of common mortgage-related expenses.

Out at 365 for a 30-year mortgage. 15-year fixed mortgages also come with lower rates than longer payment durations. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment.

In making biweekly payments those 26 annual payments effectively create an additional 13th. The loan is secured on the borrowers property through a process. You can use the following calculators to compare 20 year mortgages side-by-side against 10-year 15-year and 30-year options.

Compared to a 30-year fixed mortgage 15-year fixed rate rates are. For interest rates as of June 2022 a 30-year fixed-rate mortgage sits at 618 a 315 rise from the previous year. Your interest should match the interest cost from the mortgage calculator.

Calculator Rates 5YR Adjustable Rate Mortgage Calculator. One year ARMs used to be the standard but the market has now produced ARMs called hybrids which combine a longer fixed period with an adjustable period. Because the rate stays the same expect your monthly payments to be fixed for 30 years.

Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. Bi-Weekly Mortgage Payment Calculator. A 30-year mortgage comes with a locked interest rate for the entire life of the loan.

With 52 weeks in a year this amounts to 26 payments or 13 months of mortgage repayments during the year. Our Canadian Mortgage Calculator allows you to calculate your monthly mortgage payments and cash needed for the purchase of real estate using current lender rates. This calculator is for information purposes only and does not provide financial advice.

Use our calculator above. Prince Edward Island Charlottetown 103 Cornwall 26 Stratford 66 Summerside 82. Its interest rate stays locked for the entire term resulting in predictable monthly principal and interest payments.

2021 Custom Guildcrest Built Bungalow With A 10 Year Builder Warranty On 13. When it comes to 15-year mortgage rates they predict an average between 30 and 35. 20-year mortgages tend to be priced at roughly 025 to 05 lower than 30-year mortgages.

Your payments should match the total cost of the loan from the mortgage calculator. The same could be said for a 3 year IO or a 10 year IO loan. The Mortgage Payment Calculator allows you to calculate monthly payments average monthly interest total interest and total payment.

To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page. Need a sample amortization schedule for a 30-year fixed mortgage. Free loan calculator to find the repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds.

How to refinance your mortgage. Account for interest rates and break down payments in an easy to use amortization schedule. The best HBCUs of 2022.

The initial period can be three years 31 five. Guide to cash-out refinancing. Scotiabank Mortgage Calculator allows you to calculate your mothly mortgage payments and cash required for real estate purchases using current Scotiabank rates.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. 7YR Adjustable Rate Mortgage Calculator. The following table lists historical average annual mortgage rates for conforming 30-year mortgages.

Find and compare 30-year mortgage rates and choose your preferred lender. 3 min read Aug 26 2022.

Printable Sample Loan Template Form Contract Template Student Loans Templates

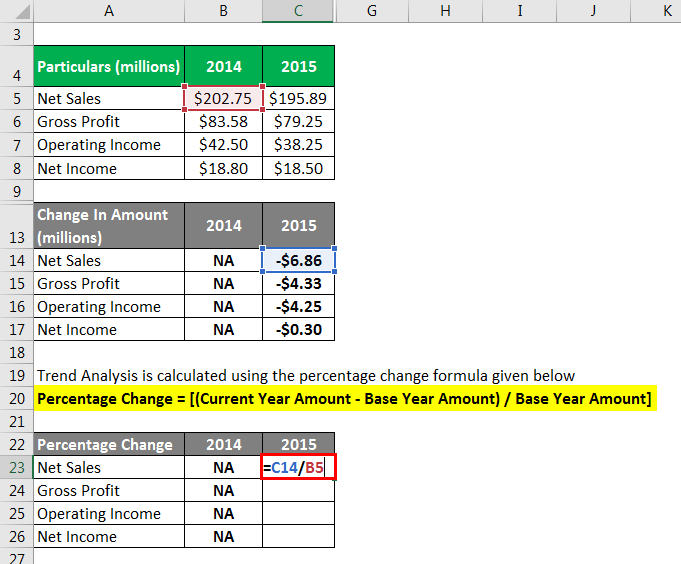

Trend Analysis Formula Calculator Example With Excel Template

1

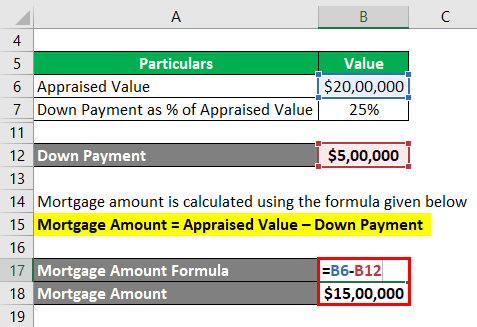

Loan To Value Ratio Example Explanation With Excel Template

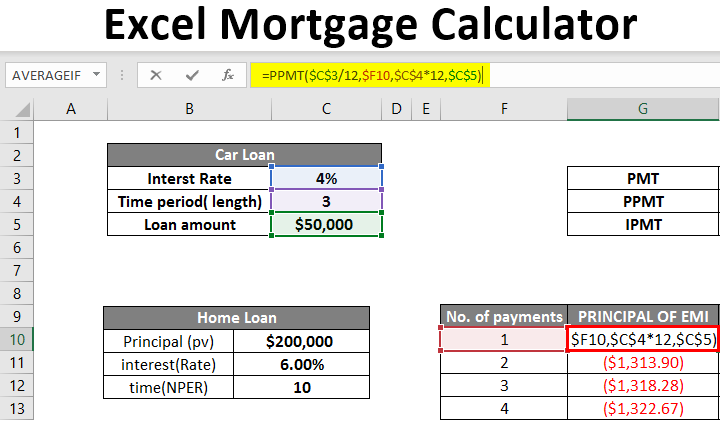

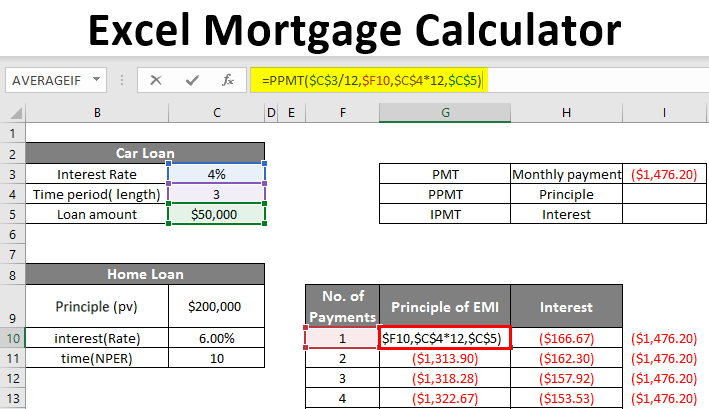

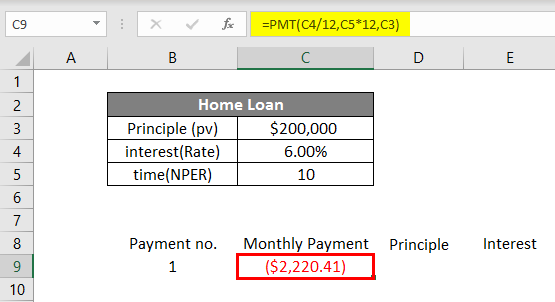

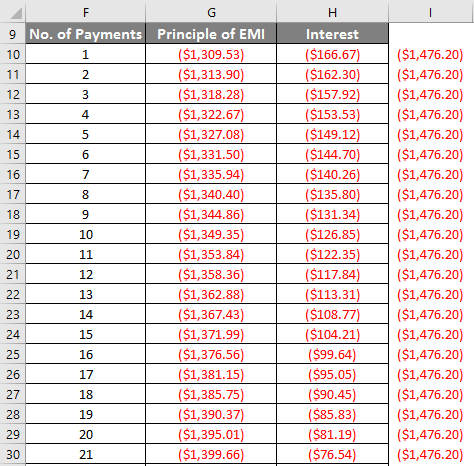

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

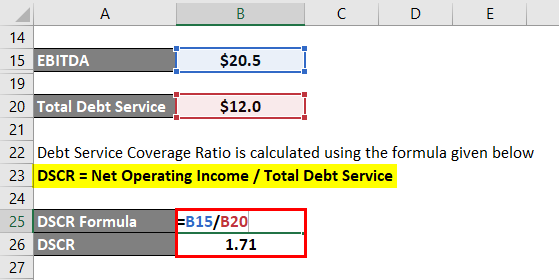

Debt Service Coverage Ratio Calculate Dscr With Practical Examples

1

5 Free Personal Yearly Budget Templates For Excel Excel Budget Template Personal Budget Template Budget Template Excel Free

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

1

Personal Loan Agreement Template New 7 Template Loan Agreement Between Family Members Contract Template Personal Loans Loan

Simple Loan Application Form Template Beautiful Personal Loans Calculator India Quick And Easy Cash Contract Template Letter Templates Personal Loans

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

1

Expense Report Template Word Lovely 11 Travel Expense Report Templates Free Word Excel Report Template Expense Sheet Templates

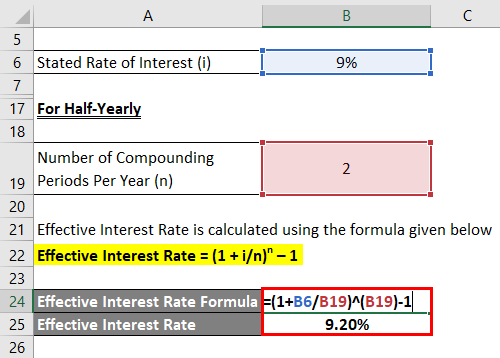

Effective Interest Rate Formula Calculator With Excel Template